[ad_1]

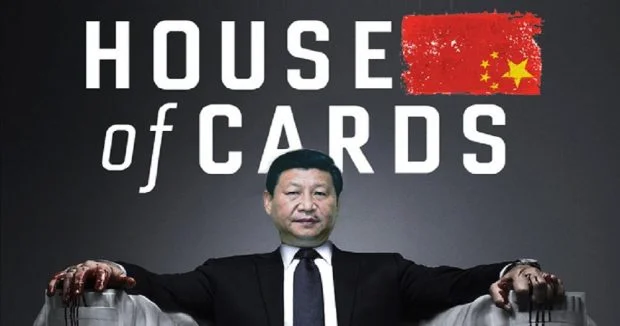

One of the most important developments in the world over the last few decades has been the rise of China as a new world power. China, whose Communist Party government has ruled now for more than 70 years, will soon have major geopolitical strategic decisions to make. Many believe that China is a house of cards ready to fall. Is this true? And if true, what would this mean for other major countries as they grapple with this reality?

It should be noted that the Chinese people are not the issue. They have a long, successful, and respected place in history and the world today. Rather the leadership (at least parts of it), that the people really have no choice at this time but to follow, is at fault. The year 2020 is turning into a pivotal year in history, as the United States chooses a potentially new political direction driven by unprecedented protests and as the world is battling a global pandemic. Let’s take a look at China’s past and its immediate future and try to discover what their geopolitical strategy may be and what effects this may have on the rest of the world today.

First, take a look at world history in terms of economic dominance over the last 2000 years. The rise in European economic power, starting in about the1600s, and then America by the 1800s, has caused major shifts in world dominance. The economic dominance primarily occurred via the innovation, of the Iron, Industrial, and later the Information Technology ages. This dominance peaked by the 1960s, giving rise back to the east – China. To a lesser degree, India and other Asian countries have also participated in this shift. And how did China achieve this? Primarily with labor arbitrage via offshoring from the dominant developed countries of the West, though more recently, some innovation is starting to occur in China moderately. Can the growth in China continue?

The argument goes that the low hanging fruit for the China growth story is finished. Offshoring (or outsourcing) opportunities will be limited and now going to other markets, if at all, under the Trump administration’s tariff policies. Now Chinese businesses are realizing the appeal (or feeling the sting, depending on your point of view) of outsourcing, sending factory jobs to Vietnam and other lower-cost Asian countries, to Mexico – which combines low costs with proximity to the lucrative U.S. market – to Africa, and now even to the United States itself.

China is beginning to get hit with market saturation. Market saturation happens when a specific market no longer demands a product or service or when the entire market has no new demand. As an organization grows, whether it be a business or even a country that is experiencing rapid growth, rapid growth rates are easier to achieve when the organization is small. As it grows, it reaches a point of market saturation, and the growth rates decline. This does not mean China will not continue to sell products and services into the developed world; it is just that growth will no longer be there as before. This may not be true if growth can be obtained from another source.

Where will new China’s economic growth come from?

- Emerging market growth will be challenging for both China and the developed world. Global growth was estimated at 2.9 percent in 2019, and in the emerging market growth is expected to be only 4.4 percent in 2020. In raw numbers, emerging market growth will be far less than needed to make up for any shortfalls in any China’s growth outlook. China exports hit a high of 35 percent in 2008 and now down to 20 percent – and declining.

- Many experts suggest that China’s best option is to energize its huge domestic economy being driven by the power of its consumers – not trade, said Chung Man Wing, investment director at Value Partners. Is this working? If one believes the China data, the answer is at best flat. China’s household consumption as a percent of GDP has hovered around 40 percent and has been relatively flat for years.

- Could China increase output via more credit? The IIF (Institute of International Finance) estimates that China’s total debt hit 317 percent of gross domestic product (GDP) in the first quarter of 2020. This 300 percent mark for many developed economies signals a danger zone where these economies can no longer sustain additional debt without significant problems in the said economy. So any significant increase in credit is not a viable option for China’s growth prospects.

- World gross capital formation as a percent of GDP is about 24 percent. For China, it is about 44 percent – nearly double the rate of the rest of the world. This is an extraordinary statistic considering China’s economic size today. As China reaches market saturation and limited options to boost GDP growth in other ways, can China maintain this level of capital formation? Most likely not.

The writing is on the wall. China needs to prepare for much lower growth rates more in line with the rest of the developed world of 2 to 4 percent. China’s growth will most likely decline 2 to 4 percent over the next coming few years. This would be on top of any other global effects that may occur, such as Coronavirus.

(Article Continues Below Advertisement)

What could be the effects of this decline for the Chinese people?

- Unemployment could become a problem. Using the application of Okun’s Law, which says that there is a corresponding two percent decrease in employment for every one percent decrease in GDP. With China’s approximate workforce of 800 million, a 4 percent reduction in GDP transforms into 64 million structural jobs lost. And with the understanding that transitory unemployment could be double or even triple during times of crisis – this translates in a time of crisis of nearly 200 million jobs lost in China.

- Credit defaults requiring massive bailouts leading to currency debasement and inflation. Transparency in Chinese banks has always been an issue, but media reports continual to show that Chinese banking is a house of cards – See example from Zerohedge; “A $20 Trillion Problem: More Than Half Of China’s Banks Fail Central Bank Stress Test.” One central bank survey showed that around 60% of household assets are parked in dubious real estate investments; some 97% of liabilities are tied up in bank loans, with mortgages almost 70% of the total. Perhaps things today look fine, but when the house of cards falls in these types of situations, it happens quickly, accelerating a downward spiral. With current central banking thinking, the only solution will be – monetize the debt leading to potential hyperinflation.

- With a potential economic downturn, China’s pension system comes under pressure. China’s state pension fund to run dry by 2035 as the workforce shrinks due to the effects of the one-child policy. Many private pension schemes with a challenging Chinese stockmarket becomes problematic as well.

- A protracted recession even depression, causing potential massive social dis-cohesion that could challenge government control.

Solutions for China? Obviously, the Chinese leadership, as well as many astute China watchers, are fully aware of their current coming economic situation. The only real question is timing – but time is of the essence. So what could the leaders of China do, given this forthcoming situation? Given that internal growth would be challenging, the only other option would be to “accept their lot in life” or … “take the space of others.” “Accepting their lot in life” most likely is not a good option, as this could cause the end of the current leadership of China and China altogether as we know it. This leaves us with the option of … “take the space of others.” Governmental leaders almost always try to preserve themselves and their positions.

Go back and look at the Economic History of World Powers chart once again. Who and how could China “take the space of others” and continue their historic expanding growth? Here we must now put on our thinking cap and postulate what actions the Chinese have already taken to see the potential strategic geopolitical direction China is headed.

- Reduce European and American economic world dominance to be replaced by their own. China would need a quick event that would cause Europe and America to take a sudden downturn in their economies. Is this not what the Coronavirus has and is doing? President Trump has vowed that the United States would continue to investigate the origin of the Coronavirus and specifically the events at the virology lab in Wuhan, China. However, China knowingly allowed COVID-19 to infect every country in the world and has not taken responsibility for their actions. Is Chinese intelligence working overtime to ensure the Wuhan investigations stall and ensuring the Coronavirus does maximum damage to Western economies via political and media control? Proof positive has yet to be established of an occurrence of a nefarious bioweapons attack on the West, but the incentives are there to fulfill a larger strategic geopolitical goal for China.

- Squeeze out the economic rise of other Asian countries via military expansionism. The recent rise of India, as well as other Asian powers, also are emerging as world economic powers. This threatens the economic space for China to grow. While the world is battling the Coronavirus, at the same time, Chinese military expansionism continues forward. After all, time is of the essence. China’s astonishing expansion into the South China Sea’s 1.35 million square miles and its subsequent militarization of the region over the past several years has cultivated a complex security environment. The border spat between India and China is turning into an all-out media war as well as capturing territory.

- A clampdown on internal dissent with more draconian reductions of civil liberties of their population. Recent events in Hong Kong and accused civil rights violations of their minority populations have occurred with little objection around the world. Internally, China has extensive programs in place to monitor and spy on their population via various forms of technology.

What of the elites of the world? Would they be content to allow the Chinese to execute this strategic plan? It would largely depend if they can participate in it. Whether they be subordinate to China or even use China as their puppet, it is the central driver to the concept of globalization. At the level of the super-elite, there is no allegiance to any flag. This may explain the elites push for centralized power in order to control the masses via non-democratic collectivist globalization, where we will be told what is good for us and non-compliance is not an option.

The Chinese have infiltrated all parts of Americana to secure their geopolitical strategy. Some in Congress have launched a congressional investigation into China’s infiltration of American college campuses, according to a letter sent to the Department of Education. Congress has also launched an investigation into Chinese espionage operations targeting confidential medical research performed by the National Institutes of Health. There are reports of Chinese infiltration that is not just American but European as well; media, technology companies, entertainment, business, military, implantation on foreign soil (more examples here and here), security, intelligence, intellectual property … to name a few. There are even reports that Chinese infiltration has reached into the halls of the United States government – see here, here and here. Note that this government infiltration is occurring on both sides of the political spectrum.

The final question one can pose; Could this Chinese geopolitical strategy work? The sober response is, yes, quite possibly. So far, it is going well for the Chinese leadership and the participating elites. The only thing that is in their way is still small pockets of populist resistance that have seen this reality – or at least parts of it. The 2020 American elections this fall will signal where the next turn of events will lead us.

[ad_2]

Read the Original Article Here